What the Federal Interest Rate Hike Could Mean for the Auto Loan Industry

By: David Straughan and Jennifer Chonillo

Affiliate disclosure: Automoblog and its partners may be compensated when you purchase the products below.

On March 16, Chairman Jerome Powell announced that, for the first time since 2018, the Federal Reserve would be raising the interest rate: from 0% – 0.25% to 0.25% – 0.5%. The Fed raised the rate again on May 4 – this time to 0.75% – 1%. These increases will impact many industries in the U.S. and around the world, especially lending and finance.

Those effects also have the potential to reverberate through industries that depend on financing, such as the automotive industry. But what those effects could be and to what extent they’ll affect the industry remain to be seen.

The Difference Between Interest Rates and “The Interest Rate”

When people talk about interest rates, they’re typically referring to the rates consumers pay to borrow money from financial institutions. When people talk about “the interest rate,” they’re usually referring to the rate set by the Federal Reserve, also known as the federal funds rate. These two are related, but the difference between them is critical.

The federal funds rate refers to the rate financial institutions pay to borrow money from one another overnight. This rate affects the rates at which those institutions can invest or lend money to businesses and individuals.

How the Interest Rate Increase Could Impact the Auto Industry

Nearly every industry will be affected by the interest rate hike in some way. But in categories like the automobile industry, which depend on both a business and a consumer’s ability to borrow money, the effects could be especially significant.

Auto Lending Rates Will Likely Go Up

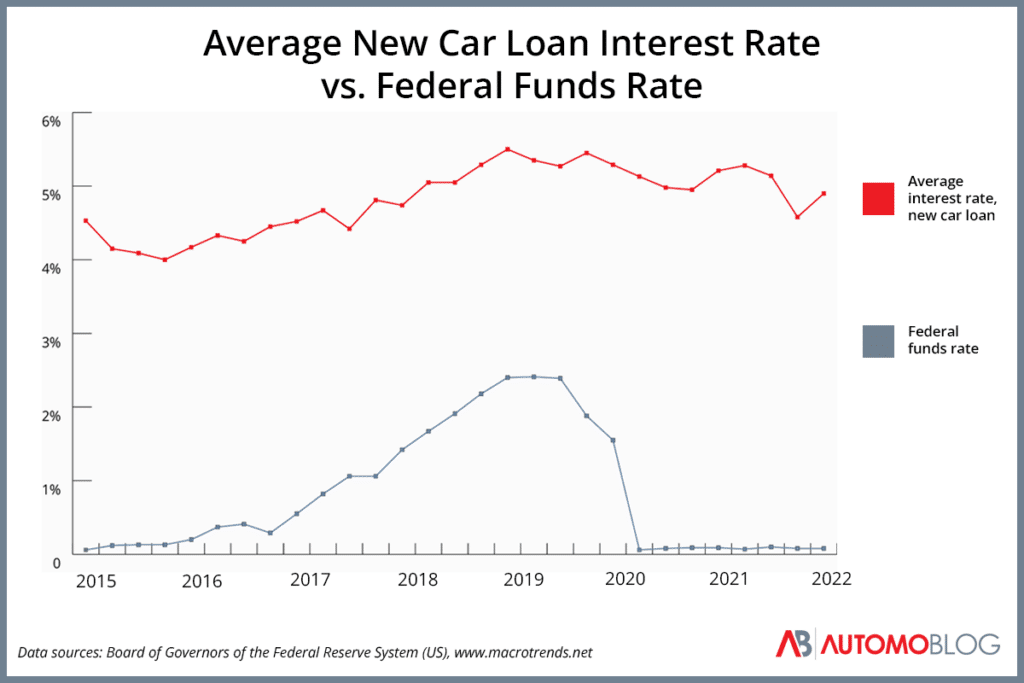

One of the most immediately noticeable effects of a rate increase is the increase in consumer borrowing rates. Like the federal funds rate, auto loan rates have been historically low in recent years. According to data from Statista , the average rate for a 60-month auto loan on a new car fell to 3.85% in December 2021. By April, it had reached 4.47%.

As it becomes more expensive for larger financial institutions to borrow money, they’ll need to charge more to make up the difference.

“In 2022, I could see [auto] lending rates climbing as high as 8% – 9% for people with less-than-ideal credit, and as high as 4% – 5% for those with average or even good credit,” said Jake Hill, CEO of DebtHammer, a company specializing in consolidating payday loans.

The data in the chart below reveals a strong relationship between the federal funds rate and the average auto loan rate. Given these historical trends, consumers should expect rates on financial products such as auto loans, personal loans, small business loans, and mortgages to come with higher interest rates.

Lower Demand Could Result in Lower Prices

The historically low interest rates over the last few years have made borrowing money to buy a car more attractive, but rising interest rates could cool consumer demand.

Cars effectively become more expensive as rates increase. Unlike improvements in vehicle technology, that extra expense doesn’t add value to the vehicle. As a result, consumers may be more reluctant to buy new vehicles, reducing demand.

That decrease in demand could lead to lower prices on new cars and perhaps even used cars as dealers look to respond.

The Rate Increase’s Effects on Auto Loans May Not Be Significant Yet

While a 0.5% rate increase may be significant enough to disrupt the market, the effect wouldn’t necessarily be enormous for a potential car buyer.

The table below uses March’s rounded average new car price of $46,000 and a 72-month auto loan (currently the most common loan term) to show how a 0.5% rate difference would affect the cost of buying a car. Taxes and fees aren’t included in the calculations.

| Interest Rate | Monthly Payment | Total Interest Paid |

| 4.5% | $730.21 | $6,574.79 |

| 5% | $740.83 | $7,339.54 |

Though a difference of less than $800 in total interest isn’t insignificant, the resulting difference of about $10 per month probably won’t mean much to most buyers.

That’s not to say lenders won’t increase their rates by more than 0.5% to account for the increase. But when it comes to the end consumer, it’s worth keeping the effects of these rate increases in context.

Demand and Prices for New Vehicles Are High

Semiconductor shortages and other supply chain issues have led to a lower supply of new vehicles since the start of the COVID-19 pandemic. This shortage has prompted a dramatic rise in the price of new and used cars – a trend that appears to be continuing. Kelley Blue Book reports that the average price for a new car exceeded $47,000 for the first time in history in December 2021 and sat just under $46,000 in March 2022.

Here are the increases in the average price of a new car over the last three years, according to a report from Kelley Blue Book :

- 2019 : $1,799

- 2020 : $3,301

- 2021 : $6,220

Some manufacturers have taken issue with these increases. For example, Thomas J. Doll, president and CEO of Subaru of America Inc., issued a warning to dealerships about selling cars over manufacturer suggested retail price. The company said consumers had been reporting dealerships that sold over MSRP to the corporate headquarters.

Three Reasons Why the Fed Is Raising the Interest Rate

The Federal Reserve derives its authority from Congress and receives monetary goals from the federal government, but it acts independently to set interest rates, and its decisions are ultimately up to its board of governors.

When it comes to recent decisions to raise the interest rate, a few factors played a role:

The Interest Rate Has Been Historically Low for a Long Time

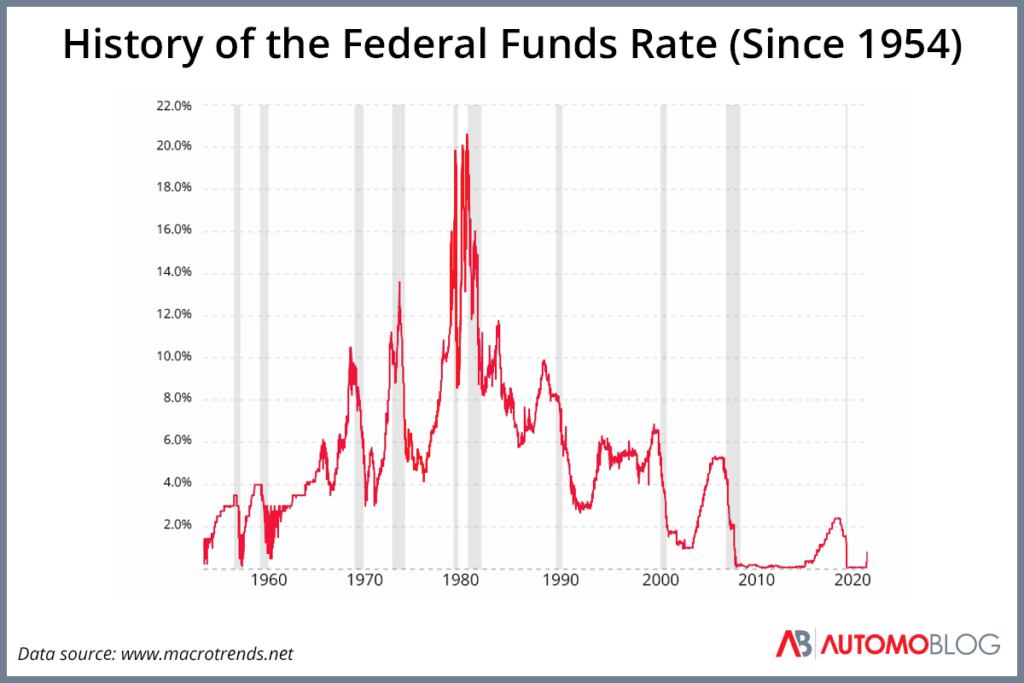

One reason the interest rate is going up is that it doesn’t have anywhere else to go. Before the rate hike in March, the interest rate at the Federal Reserve was between 0% and 0.25% – a low first seen during the 2008 financial crisis.

The Labor Market Appears to Be in Good Shape

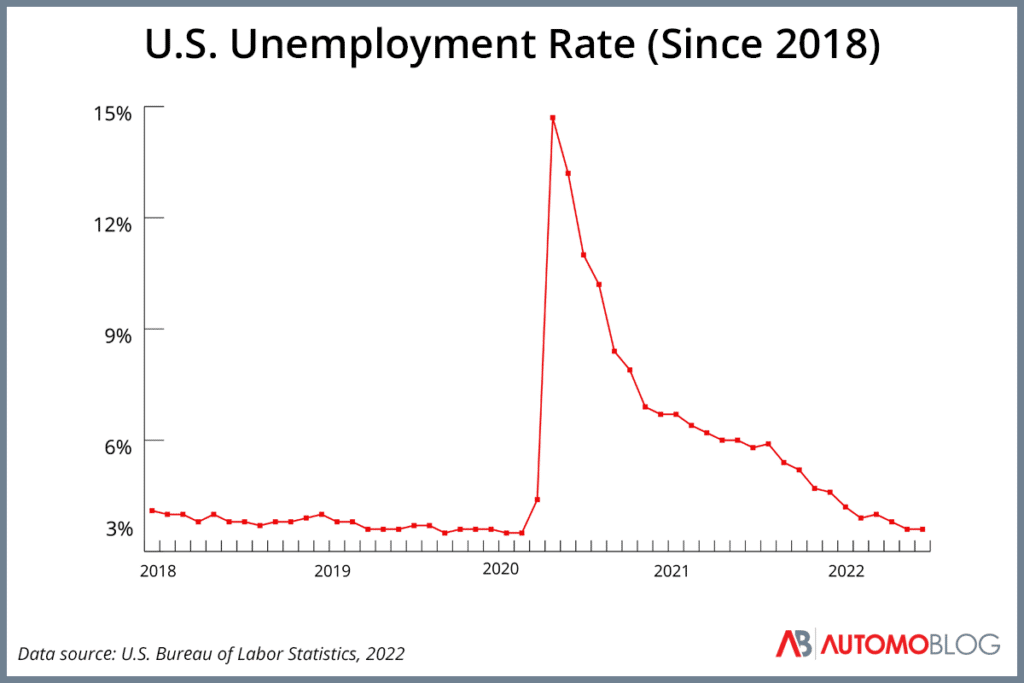

After a dramatic increase in the unemployment rate in 2020 due to the COVID-19 pandemic, the U.S. labor market has made a strong recovery. The unemployment rate was 3.6% in April, according to the U.S. Bureau of Labor Statistics.

Such a low rate of unemployment indicates a healthy economy. This gives decision makers at the Fed confidence that the country could withstand a gradual slowdown of economic activity brought on by an increase in the interest rate.

Inflation Has Been on the Rise

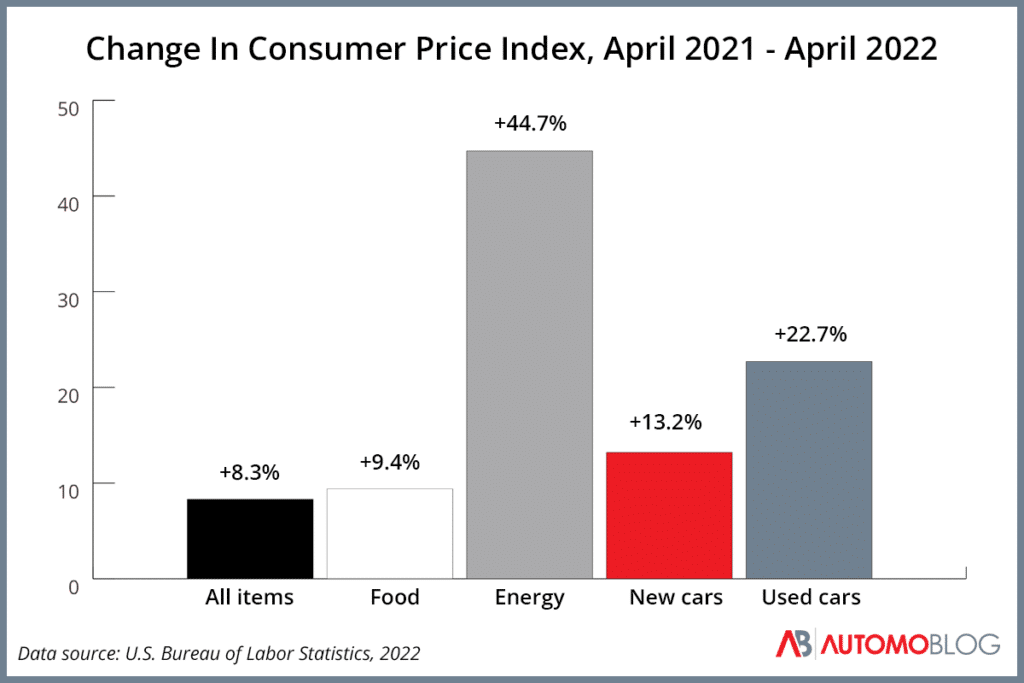

A strong economy and a long period of low interest rates have led to an uptick in inflation in recent months. According to the Federal Reserve , current monetary policy aims for keeping inflation near 2%. However, between April 2021 and April 2022, the Consumer Price Index (CPI) which measures inflation, rose by 8.3% (not seasonally adjusted).

Raising the interest rate is one of the first tools the Federal Reserve uses to try to temper inflation. By increasing the rate, the Fed hopes to slow economic growth and, in turn, the rise in the cost of goods and services.

The Interest Rate Likely Won’t Go Down any Time Soon

It’s true that with the two recent increases in the federal funds rate, the difference is currently minimal for most consumers. Even after those increases, the rate is still lower than at most points in the history of the Federal Reserve. As of now, businesses and individuals generally still have access to low borrowing rates.

However, the Federal Reserve has indicated that there are still five more interest rate increases to come in 2022. That means consumers should expect more increases in their own interest rates, auto loans included.

Hill, of DebtHammer, says it’s hard to anticipate where rates will go in 2023.

“Every aspect of the economy is volatile right now, and during times like these, unprecedented changes can happen on a whim,” he says. “Because there isn’t a solid, consistent pattern, predicting 2023 interest rates at the moment is very difficult.”

Whatever impacts the most recent increase has had on the auto industry and others may be exacerbated by future rate hikes. The Federal Open Market Committee will meet again on June 14 and 15, where they’re expected to once again raise the federal interest rate.

FOR ASSISTANCE CALL 888-270-5835

All Rights Reserved | NVP Warranty